Greenlight

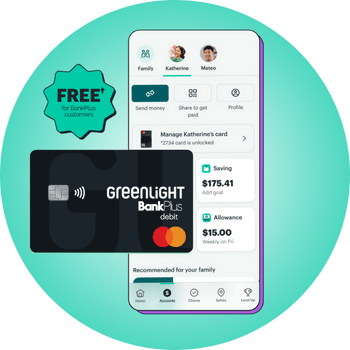

Get Started with GreenlightThe debit card for kids. Free* for BankPlus families.

Greenlight is the award-winning money app trusted by over 6 million parents and kids. With their own debit card, kids and teens gain real-world experience managing money, while parents can easily send funds, receive instant notifications, and set flexible spending controls. Families can choose between two plans: Select, which provides all the essential money management tools at no cost when linked to a BankPlus checking account, and the Infinity Select, which includes everything in Select plus enhanced safety and protection features like identity theft coverage, purchase protection, and family location sharing.

WHAT YOU GET WITH GREENLIGHT

Get your free* subscription today

BankPlus customers can get Greenlight Select for free* through our Greenlight partnership. With Select, you’ll receive the debit card and money app at no cost. To sign up, click the link below or call (888) 483-2645 and ask to be added to the BankPlus Greenlight partnership program.

Get Started with Greenlight

A debit card for kids. And so much more.

A debit card for kids. And so much more.

Build lifelong money skills

Kids and teens learn to spend wisely while they track their spending and savings — and with the option to create a custom card, they can do it in style.

Security for peace of mind

FDIC-insured up to $250,000, backed by Mastercard’s Zero Liability fraud protection, and built with parental controls to block unsafe spending.

Chores and allowance

Assign chores and automate allowance - with the option to connect payouts to chore progress.

Debit card and money app

Send money quickly set flexible controls, and get real-time notifications.

Savings goals

Set savings goals for what your kids really want - and reach them together.

From saving to investing — Infinity takes kids further.

The Infinity plan adds investing for kids and teens, plus family safety features, on top of everything in Select. Upgrade for only $9.99/month.

Investment Services Are : Not a Deposit | Not Bank Guarantee | May Lose Value | Not FDIC Insured | Not Insured by an Federal Government Agency

Upgrade To Infinity Select TodayCompare Greenlight Options

From Greenlight to Student Checking: A Path to Financial Independence

Greenlight helps kids builds smart money habits. When they’re ready, BankPlus Student Checking+ gives them their own account—no ATM fees++, mobile banking+++, and real financial freedom.

Learn More About Student CheckingFAQ

How does saving work on Greenlight?

Kids save money on Greenlight in several ways.

- Add a savings goal.

- Turn on Round Ups to send spare change from purchases to savings.

- Automate a percentage of allowance to savings.

- Use Parent-Paid Interest to set and pay an interest rate on your kids’ savings.